In a romantic view of democracy, legislators act with the interests of the general public in mind. They grapple with policy issues, work toward a broad consensus, and pass legislation that has strong support. To ensure that funds are spent wisely, they frequently reevaluate existing programs and prune the low-value and harmful ones. They put citizens first and carefully limit their actions to those allowable under the U.S. Constitution.

The problem with this “public interest theory of government” is that it has little real-world explanatory power.1 Congress often enacts ill-conceived laws that do not have broad public support. Many programs perform poorly year after year, but rather than being canceled they receive growing budgets. Programs are almost never terminated because legislators have a hard time admitting that their policy ideas have not worked. Legislators try to evade blame for government failures, and they only attempt to fix problems after high-profile scandals have occurred.

To explain the frequent failure of federal policies, we need a realistic view of Congress. First, we should assume that legislators generally pursue self-interested goals, just as the rest of us do. Second, we should look at the features of our democratic process that shape political incentives. This essay argues that those incentives often steer legislators toward policies counter to the general public interest.

Beliefs of Voters

Politicians want to get elected, and so they pay attention to the beliefs of voters in their states and districts. Most voters are not experts in economics or national affairs, and they are too busy with their lives to pay much attention to federal policy. At the same time, the activities of the federal government have become so complex that even informed citizens know only a fraction of what it does.

In the marketplace, consumers have a strong incentive to examine products and make sure that they get a good deal. By contrast, people know that their individual votes in elections will have almost no effect on outcomes, and so they have little reason to research candidates and policies in detail. As a result, people tend to know more about, say, their favorite television shows than about the workings of the federal government. It is logical for most people to be “rationally ignorant” about public policy, meaning that it does not pay for them to investigate the issues.2 Opinion polls of Americans over the decades have found “appalling levels of ignorance” about federal policy, notes Yale University law professor Peter Schuck.3

Unfortunately, “politicians know this, and hence they attempt to design policies that will attract ill-informed voters,” concluded economist Gordon Tullock.4 That assessment seems harsh, but politicians clearly have an incentive to favor policies that have short-run appeal and offer a “free lunch,” but that have less visible long-run costs.

In a 2007 book about voters and politicians, economist Bryan Caplan argues that “voter ignorance opens the door to severe government failure.”5 Voters do not have strong incentives to find out about the costs and benefits of programs. And because the federal government is a monopolist in much of what it does, people cannot easily compare alternatives.

Caplan argues that many voters are not just ignorant, but also “irrational,” meaning that they support policies that make themselves worse off.6 People do not make hard-headed decisions about public policy by looking at the actual costs and benefits. Rather, they indulge their emotional and ideological feelings, often in an environment of biased information generated by special interest groups. Some of the irrational notions of voters are systematic, and that encourages politicians to persist in failed policies.

Public polling data show that Americans have a dim view of federal government performance.7 Most people think that the government is incompetent and wasteful, and they are correct in that assessment. So how can scholars such as Caplan say that people are “ignorant” and “irrational?” The answer seems to be that people know enough to be aware of the big-picture problems in Washington, such as the huge deficits and all the lobbying and corruption. But few people have knowledge about what the best solutions to such problems are. And that is where politicians gain leeway—they tell their constituents that Washington is indeed messed up, but that they can be trusted to tackle the problems.

Incentives of Politicians

In 1787 James Madison wrote that legislators sought office “from 3 motives. 1. ambition 2. personal interest. 3. public good. Unhappily the two first are proved by experience to be most prevalent.”8 Politicians have not changed much since Madison’s time. But these motivations are not the key to understanding whether government policies succeed or fail. For one thing, motivations are hidden. All politicians claim to be public-spirited—Madison himself said that selfish motives are “masked by pretexts of public good and apparent expediency.”

Rather than looking at inner motivations, we can better understand congressional actions by looking at incentives. The fundamental incentive steering political behavior is reelection. If members do not satisfy voters in their districts, they will not survive in Congress. Furthermore, the most powerful positions in the House and Senate go to the members who have been there the longest, so the quest for reelection drives much of what Congress does.

Responding to the needs of voters in a democracy can be a good thing, but in Congress it has also become a key source of policy failure. Members put their states first, and that often comes at the expense of the general interests of all Americans. When summing up his two decades of congressional experience in a 2014 farewell address, Sen. Tom Coburn of Oklahoma focused on how his colleagues often sought narrow benefits for their states at the expense of American liberties and the U.S. Constitution.9

Congress has geographical representation and a decentralized power structure. Members have families and business ties in their states, as well as emotional attachments. So it is logical for them to seek federal benefits for their states because most of the costs will fall on other states. This is a major factor causing federal failure. The structure of Congress leads members to support programs that benefit their states but that are losers for the nation as a whole.

Even in the crucial role of providing national defense, the pursuit of parochial advantage “has become a full-time preoccupation that permeates Congress’s activities and members’ decisionmaking processes.”10 That is the view of Winslow Wheeler in his book, The Wastrels of Defense. As a long-time congressional aide, Wheeler found that members responsible for national defense put most of their efforts into grabbing benefits for their states, rather than overseeing the Pentagon and ensuring the effectiveness of our armed forces. He argued that Congress has “degenerated into a gaggle of wastrels competing for selfish advantage.”11

That view is not entirely accurate. Some legislators do rise above parochial politics and pursue broader goals. Many members hold safe seats, and so they have some flexibility. Also, because many voters remain ignorant about the details of policy, legislators have leeway to pursue their own private and ideological goals. The problem is that these other goals often produce failed policies as well. There is no built-in check—no invisible hand, as in markets—to guide members to make value-added decisions, so their personal beliefs about policy may be untethered from reality.

Such untethered beliefs are usually activist in orientation. People who enter politics tend to think that government programs are a powerful way to solve problems. That is an understandable belief. The benefits of government action are immediate and visible, while the costs are often more distant and abstract. Politicians are encouraged to fix problems in society, and it seems reasonable to them that spending and regulation should work. Many politicians see themselves as philanthropists trying to help people.12

This activist disposition is reinforced by the environment in Washington. Special-interest groups dominate policy discussions. Most witnesses to congressional hearings favor the programs being examined, and they focus on program benefits, not the costs. Most visitors to member offices on Capitol Hill are there to plead for special benefits. And members know that if they vote to confer benefits on interest groups, they will receive awards that they can hang on the walls of their offices and brag about on their websites.

All of this encourages Congress to create new and expanded programs.13 The federal government has 47 job training programs in 9 different agencies.14 It has 15 programs for financial literacy.15 It has 15 agencies overseeing food safety, 20 programs for the homeless, 80 programs for economic development, 82 programs for teacher quality, and 80 programs for helping poor people with transportation.16 It has 10 offices that address AIDS in minority communities, 11 agencies that do autism research, and 8 offices in the Pentagon to handle prisoner-of-war and missing-in-action issues.17

There are bureaucratic reasons for some of this duplication, but the main cause is that Congress has dozens of committees and subcommittees, and each one wants a crack at “solving” problems in society. Legislators are entrepreneurs, and they gain prestige by creating new programs. Trimming low-value and obsolete programs is not much fun and it creates enemies, so few members focus their attention on that.

Programs accumulate over time because members have little incentive to repeal the failures. Members do not want to admit that their favored programs have failed because their careers, reputations, and pride are on the line. The goals of their programs seem pure to them, so they overlook the flaws. And, unlike in the private sector, there is no profit and loss accounting in government activities to clearly signal failure.

Even when federal failures are obvious, members of Congress are not accountable for them. When something goes wrong, they blame the bureaucracy. One consequence is that Congress has little incentive to draft workable laws. Paul Light of the Brookings Institution examined dozens of major federal failures of recent years and found that the most common problem was poorly drafted laws: “Poorly designed policies come from Congress and the president, for example, and may be impossible to implement regardless of bureaucratic commitment.”18

Politicians always tout what their programs are supposed to do, but whether programs actually work is less important to them. Democracy has many advantages, but it does not prevent policymakers from supporting a large number of failed programs.

Cost-Benefit Tradeoff

Congress proceeds with many failed policies because it does not confront direct cost-benefit tradeoffs. In the marketplace, people compare a product’s cost to the expected benefits before they spend their money. Politicians do not face such a tradeoff. They are spending other people’s money, which nobody spends as carefully as his own.

Furthermore, congressional spending decisions are often separated from taxing decisions. Agriculture committees, for example, vote on farm bills that cost hundreds of billions of dollars, but those committees do not deal with the unpleasant task of raising the taxes to pay for them. To the spending committees in Congress, the source of financing for their programs is usually someone else’s problem.19

The pro-spending bias is exacerbated by the fact that the full costs of programs are rarely considered. The costs to the private sector of government spending include not just the direct tax costs, but the “deadweight losses” imposed in the process of extracting taxes from individuals and businesses. Another cost is the compliance burden of programs. Taxes, regulations, and spending all burden people with paperwork, which diverts their efforts away from more productive activities. So when Congress focuses on the benefits of programs, but does not consider the full costs, lawmakers are biased in favor of supporting low-value or negative-value programs.

There is another hurdle to Congress making sound cost-benefit tradeoffs: costs are benefits to legislators. In markets, costs are something to be minimized. But for legislators, costs represent spending on constituents, which is a political benefit. Consider a proposal to close down a low-value federal facility in a state. For the nation, the facility’s modest benefits are outweighed but its larger taxpayer cost. But for the legislators with the facility in their state, the cost represents beneficial local spending. So to them, there is no tradeoff because both benefits and costs are benefits.

In Congress, we often see members fighting to spend money in their districts on weapons systems that the Pentagon does not want. And we see members opposing the closure of post offices and other federal facilities in their districts that are not needed. Sound federal policymaking has always suffered from such parochial pressures. A century ago, for example, Congress was keeping open unneeded Army posts that had been created to fight Indians decades earlier, as well as old assay offices that the U.S. Treasury said were no longer needed.20 It was also constructing too many post offices in places where the postmaster general did not want them.

Perhaps in their hearts, many members of Congress try to put the national interest ahead of their narrow parochial interests. The problem is that they face a prisoner’s dilemma: if they do not try to secure funding for their favored programs, they know that the money will be carved up and spent by other members, not saved. This problem is also called a “common pool” problem. The budget is like a fish stock in the ocean that gets depleted as each fisherman tries to maximize his catch. In sum, most members of Congress—even those who favor overall restraint—will pursue all the spending they can for their own states and preferred programs.

Concentrated Benefits, Diffuse Costs

Many federal programs deliver benefits to narrow groups of people but spread the costs widely across the population. Small groups of individuals and businesses are easier to organize than larger groups, and they have more focused goals, so they can be very effective in lobbying Congress for benefits.21 The costs of narrow benefits—such as subsidies and regulatory advantages—are often diffused across tens of millions of taxpayers or consumers, often without the victims knowing that their pockets are being picked.

The federal sugar program is a good example. The benefits go to several thousand sugar producers, while the costs are spread across millions of consumers in the form of higher prices. Most Americans probably do not know that federal laws raise the price of sugar. And if they did know and complained to Congress, their voices would be drowned out by the professional lobbyists defending the program.

Economist Frederic Bastiat in the 19th century described why arguments for such special-interest policies were often successful. With regard to trade barriers, he said, “Protection concentrates at a single point the good that it does, while the harm that it inflicts is diffused over a wide area. The good is apparent to the outer eye; the harm reveals itself only to the inner eye of the mind.”22

Washington is teaming with lobbyists seeking special benefits—subsidies, regulations, trade protections—that come at the expense of the general public. Economists call this activity “rent seeking,” where “rent” means an abnormal profit. People often blame lobbyists for the problem, but rent seeking is a two-way street. Jonathan Rauch of Brookings noted, “In the public’s mind, the standard model of lobbying in Washington involves special interests buying influence, in a sort of legalized bribery. In fact, the process more often involves politicians shaking down special interests.”23

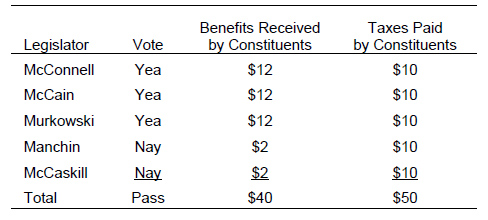

It is easy to see why individual politicians support bills that include narrow breaks that they favor. But how do such bills gain a majority vote in Congress if they are bad for the nation? Table 1 provides an answer. A five-person legislature votes on a hypothetical program that provides nationwide benefits of $40 but costs taxpayers $50. Assuming that legislators vote in the narrow interests of their states, the program garners a majority vote. The key to the program’s political success is that its benefits are more geographically concentrated than its costs. The legislation is a political success, but it is a failure for the nation because it costs more than it is worth.

Table 1. Majority Voting Does Not Ensure That Benefits Outweigh Costs

Logrolling

Congress operates as a complex web of vote trading or logrolling. This key mechanism allows low-value and harmful programs to be passed. Logrolling usually works by bundling in a bill narrow provisions that benefit different states and interest groups. The committee system supports the logrolling process, as it helps “members of Congress secure deals with one another, making sure that logrolls are durable over time.”24 Within the agriculture committees, for example, Congress bundles subsidies for different crops, each of which is important to different states. Also, farm bills typically include benefits for urban interests. These bills pass even though many specific provisions would not have majority support in Congress or among the public.

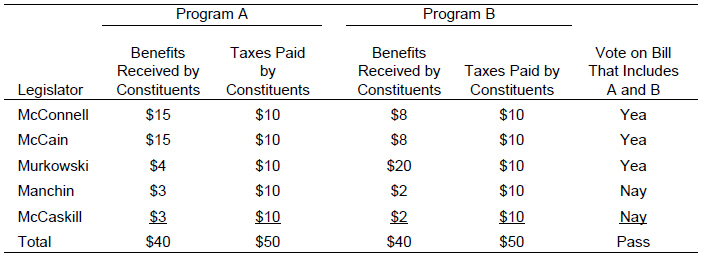

Table 2 shows how two subsidy programs, A and B, that both have higher costs than benefits can pass Congress. Neither program has majority support, and each would fail if voted on separately. So McConnell, McCain, and Murkowski agree to bundle the two programs in one bill. They logroll. The two programs get approved, even though both of them impose a net cost on society.

Table 2. Logrolling Allows Passage of Narrow Subsidies

Numerous factors strengthen the logrolling system in Congress. Committee chairs gather votes on bills by including special-interest provisions requested by each member. Members with safe seats can raise extra campaign cash, which they offer to other members in return for their support on special-interest bills. Conscientious members who raise objections to special-interest bills get punished by party leaders.

Logrolling has been around since the 19th century. An early example was the Rivers and Harbors Act of 1826, which sprinkled Army Corps of Engineer projects across a dozen states to ensure its passage.25 From the beginning, people have complained about the harmful effects of such bills. In an 1835 speech, Tennessee Rep. Davy Crockett said that he refused to go along with the “log-roll” system in the House.26 And in 1836, Virginia Rep. John Patton criticized a rivers and harbors bill in the House as a “species of log-rolling most disreputable and corrupting.”27

Studies in 1914 and 1919 by Chester Collins Maxey described the early history of “pork-barrel” legislation and “log-rolling.”28 He said that before the use of omnibus bills, legislation of “purely local interest” usually failed to pass, which made sense because such bills only had narrow support.29 But after Congress started passing omnibus river and harbor bills, Maxey observed that about half of the projects included were “pure waste.”30 Numerous members of Congress during the 19th century had similar opinions about the low-value of projects in these bills.31

The inclusion of projects in omnibus bills was typically not based on merit, but by the need to gain votes. Regarding river and harbor bills, Maxey said, “Committees have seldom been free to frame bills according to their own views of what was best for the country, simply because the merciless pressure brought to bear upon them by their associates in Congress” to approve particular projects.32 In 1886 Wisconsin Rep. Robert La Follette complained about the “pernicious system” of logrolling, saying that members spent their time bickering about getting their share of funding rather than judging the “real merits of any of these improvements.”33

Pork barrel spending has usually been accompanied by hypocrisy. In 1866, Missouri Sen. George Vest—who was on the committee overseeing river and harbor bills—complained about members who came to him privately begging for projects, but then went to the Senate floor to “denounce the whole scheme of the bill as a piece of unconstitutional corruption.”34 President Ronald Reagan’s budget chief, James Miller, recalls similar spending hypocrisy. Members privately pushed him for projects in their districts, but then would publicly bash the administration for not being tightfisted enough.35

When Maxey was writing, logrolling was expanding its grip on the federal budget. Members had long sought new post offices and other federal buildings in their districts, but these efforts often failed on stand-alone votes. Maxey said that in 1902 Congress began using omnibus bills for public buildings, and that led to an “avalanche” of new spending.36 He described a similar spending increase after Congress switched to omnibus bills for veterans’ pension claims in 1908.

Maxey concludes that “our government has suffered inestimable financial losses through log-rolling measures. The amount of money which has been directly or indirectly wasted upon unnecessary public buildings, obsolete and poorly located military posts, undeserved pensions, and the like can only be estimated; but it is safe to guess that it is enormous.”37 As a mechanism of waste, logrolling works the same way today, but the magnitude of spending is much greater.

These days, large omnibus bills that pass are usually portrayed by legislators as a victory for “bipartisan cooperation.” And it is true that, in theory, logrolling can create an efficient outcome in some situations.38 But, much of the time, logrolling leads to negative results, and it runs counter to the democratic ideal understood by most citizens of true majorities approving policies. Economist Frederic Hayek said that legislatures should seek majority agreement on measures of general policy, but “the so-called approval by the majority of a conglomerate of measures serving particular interests is a farce. Buying majority support by deals with special interests … has nothing to do with the original ideal of democracy, and is certainly contrary to the more fundamental moral conception that all use of force ought to be guided and limited by the opinion of the majority.”39

Fiscal Illusion

Ideally, federal legislators would carefully evaluate programs by comparing the costs to the benefits, and they would do so in a manner transparent to the public. However, legislators have developed numerous techniques to hide the costs of federal spending. As a result, people perceive the “price” of government to be lower than it really is, and they demand too much of it. Economists call this bias “fiscal illusion.”40

Here are some of the ways that legislators hide the costs:

- Debt. The federal government currently finances more than $400 billion a year of its spending with borrowing. People see the benefits of the spending, but the costs are pushed to the future in the form of accumulated debt. The federal government ran deficits 85 percent of the years between 1930 and 2015.41 Deficit spending is a chronic failing of modern governments. A survey of 20 high-income industrial countries covering 1960 to 2011 found that 14 of them ran deficits in more than three-quarters of those years.42

- Withholding. The federal government requires employers to withhold income and payroll taxes from worker paychecks, which makes earnings disappear before workers can see the cash. Withholding was introduced during World War II to make paying taxes feel less painful and thus to reduce taxpayer resistance to it.43

- Business Taxes. The federal government collects hundreds of billions of dollars a year from taxes on businesses, including the corporate income tax and the employer half of the federal payroll tax. The burden of these taxes ultimately falls on individual savers, workers, and consumers, but the collection is invisible to them.

- Real Bracket Creep. The federal income tax is indexed for inflation, but not for real economic growth. Because the income tax is graduated—rates rise as one earns more—the system results in the government automatically and invisibly gaining a larger share of American incomes over time.

- Penalize a Minority. Higher-income households pay a much larger share of their income to federal income taxes than do lower-income households. As a result, a small minority of earners—those who have the highest incomes—pay the great majority of all income taxes. The political effect of this tax structure is to bias people with lower and middle incomes to favor government expansion because most of the tax bill is paid by others.

- Complexity. Congress has spread out the federal tax burden across multiple different tax bases. It has also made the largest tax—the income tax—hugely complex. These techniques of tax design reduce the ability of voters to appreciate the overall cost of the government.

- Regulations. When Congress wants to confer benefits on a group of voters, a less-transparent alternative to a tax-funded spending program is a regulation. For example, current federal mandates require businesses to provide employees with health insurance, family and medical leave, facilities for the disabled, and other benefits. The costs of such mandates ultimately fall—in a hidden manner—on individuals in the form of lower wages or higher prices.

- Smoke and Mirrors. The government uses various accounting tricks to sidetrack budget rules so that spending programs get approved. For example, Congress partly funded the 2014 highway bill with a gimmick called “pension smoothing,” which changed the timing of business taxes.44 Another common trick is the “salami strategy,” which is used by executive branch agencies, such as the Pentagon, on large projects. With this technique, the full costs of projects are only revealed a slice at a time, so that by the time the full costs are evident, the project is too far along to be canceled. This is one reason why federal projects often have large reported cost overruns.45

The use of fiscal illusion is a contributing factor to government failure. By partly hiding the burden of government, policymakers are emboldened to pursue ill-advised programs that have higher costs than benefits. Citizens and voters are left in the dark, not recognizing that the costs of all the benefits pouring forth from Washington are higher than they seem.

Conclusions

Federal laws, regulations, and programs have proliferated over the decades. Many of these policies have failed, but Congress does not have the time, inclination, or incentives to fix them. Members of Congress generally focus on new initiatives, and pruning the waste is a less attractive activity so they avoid it.

As a result, failed programs do not disappear, they just keep piling up. In a 1964 speech, Ronald Reagan said, “A government bureau is the nearest thing to eternal life we’ll ever see on this earth.”46 The larger the federal government becomes, the more obsolete programs with eternal lives will get imposed on society.

What is the solution? The public should press Congress to make fiscal and procedural reforms. Those reforms should include tighter spending restraints, more rigorous evaluations of programs, and more transparency in budgeting. Constitutional amendments to limit congressional terms and impose greater fiscal discipline are also promising ideas.

To improve federal performance, we need to cut the government’s size. In recent decades, the federal government has expanded into hundreds of areas better left to state and local governments, businesses, charities, and individuals. The ongoing centralizing of government power is a tragic mistake, and it is delivering steadily worse governance to Americans over time.

Reforms should shift federal activities back to the states and the people. State politicians face similar counterproductive incentives as those discussed in this essay, but their failures are not thrust onto the whole nation. Indeed, when policies fail in some states, other states can learn the lessons and pursue different strategies. Furthermore, the states compete with each other for people and investment, which creates discipline and ongoing pressure to reform.

Polls show that Americans support moving power out of Washington. Large majorities of people prefer state rather than federal control over education, housing, transportation, welfare, health insurance, and other activities.47 In recent decades, there has been a steady shift in public opinion in favor of federalism or the decentralizing of power.48

In sum, political incentives induce members of Congress to take short-sighted and parochial actions that undermine the overall prosperity of the nation. The morass in Washington will not be solved by putting a different party in charge or appointing different officials to agencies. The only sure way to improve government performance is to greatly cut Washington’s power and give responsibility back to the states and the people.

1 The frequent failure of federal programs is discussed in Peter H. Schuck, Why Government Fails So Often: And How It Can Do Better (Princeton, NJ: Princeton University Press, 2014).

2 Indeed, public choice economists argue that it is rational for citizens to abstain from voting since their votes count for so little. So why do so many people vote anyway? The answer seems to be that they feel that it is their responsibility and that it makes them feel like good citizens.

3 Schuck, Why Government Fails So Often, p. 156.

4 Gordon Tullock, “The Theory of Public Choice,” in Gordon Tullock, Arthur Seldon, and Gordon L. Brady, Government Failure: A Primer in Public Choice (Washington, DC: Cato Institute, 2002), p. 7.

5 Bryan Caplan, The Myth of the Rational Voter: Why Democracies Choose Bad Policies (Princeton, NJ: Princeton University Press, 2007), p. 100.

6 Decades ago, economist Joseph Schumpeter made similar observations. He said, “the typical citizen drops down to a lower level of mental performance as soon as he enters the political field.” And citizens tend to have “irrational prejudice and impulse” when it comes to politics. Quoted in Dennis C. Mueller, Public Choice II (Cambridge, UK: Cambridge University Press, 1989), p. 348.

7 For example, see Pew Research Center, “Public Trust in Government: 1958–2014,” November 13, 2014.

8 James Madison, “Vices of the Political System of the United States,” in Philip B. Kurland and Ralph Lerner, eds., The Founders’ Constitution (Chicago, IL: University of Chicago Press, 1987), chapter 5, http://press-pubs.uchicago.edu/founders/documents/v1ch5s16.html.

9 Coburn’s address is available at Russell Hulstine and Emory Bryan, “U.S. Senator Coburn Gives Emotional Farewell Address to Senate,” www.newson6.com, December 11, 2014.

10 Winslow T. Wheeler, The Wastrels of Defense: How Congress Sabotages U.S. Security (Annapolis: Naval Institute Press, 2004), p. 83.

11 Ibid., p. 16.

12 James Payne explores this idea in James L. Payne, “Budgeting in Neverland,” Cato Institute Policy Analysis no. 574, July 26, 2006.

13 For an analysis of the causes of excessive government growth, see Mark A. Zupan, “Cancer on the Body Politic: Government Self-Capture and the Decline of Nations,” University of Rochester, January 2015.

14 Chris Edwards and Daniel J. Murphy, “Employment and Training Programs: Ineffective and Unneeded,” DownsizingGovernment.org, Cato Institute, June 2011.

15 Gregory Korte, “GAO Report: Billions Spent on Duplicate Federal Programs,” USA Today, February 28, 2012.

16 Damian Paletta, “Billions in Bloat Uncovered in Beltway,” Wall Street Journal, March 1, 2011.

17 Gregory Korte, “Government Often Has 10 Agencies Doing One Job,” USA Today, April 8, 2014.

18 Paul C. Light, “A Cascade of Failures,” Brookings Institution, July 2014, p. 11.

19 There are exceptions. For example, highway spending is (supposed to be) tied to a dedicated revenue stream through the highway trust fund. Also, in some situations, budget rules require legislators to provide a funding source for proposed spending.

20 Chester Collins Maxey, “A Little History of Pork,” National Municipal Review 8, no. 10 (December 1919): 691–705.

21 Mancur Olson developed ideas regarding the ability of different groups to organize in Mancur Olson, The Logic of Collective Action: Public Goods and the Theory of Groups (Cambridge, MA: Harvard University Press, 1965).

22 Frédéric Bastiat, Economic Sophisms (Irvington-on-Hudson, NY: Foundation for Economic Education, 1964), p. 4.

23 Jonathan Rauch, Government’s End: Why Washington Stopped Working (New York: Public Affairs, 1994), p. 91.

24 Jay Cost, A Republic No More: Big Government and the Rise of American Political Corruption (New York: Encounter Books, 2015), p. 215.

25 The 1826 law is available from the Army Corps of Engineer’s website at http://planning.usace.army.mil/toolbox/library/WRDA/rha1826.pdf.

26 Davy Crockett, An Account of Col. Crockett’s Tour to the North and Down East, in the Year of Our Lord One Thousand Eight Hundred and Thirty-Four (Philadelphia: E. L. Carey and A. Hart, 1835), p. 120. The book is available at https://books.google.com.

27 Chester Collins Maxey, “Log-Rolling,” Thesis for Master of Arts, University of Wisconsin, 1914, p. 3.

28 Maxey, “A Little History of Pork,” and Maxey, “Log-Rolling.”

29 Maxey, “A Little History of Pork.”

30 Ibid.

31 Maxey quotes many members of Congress during the 19th century. Maxey, “A Little History of Pork.”

32 Maxey, “Log-Rolling.” p. 16.

33 Ibid., p. 30.

34 Ibid., p. 18.

35 James C. Miller III, Monopoly Politics (Stanford, CA: Hoover Institution Press, 1999), p. 70.

36 Maxey, “A Little History of Pork.”

37 Maxey, “Log-Rolling,” p. 39.

38 Dennis C. Mueller, Public Choice II (Cambridge, UK: Cambridge University Press, 1989), p. 83.

39 F. A. Hayek, Law, Legislation and Liberty, Volume 3: The Political Order of a Free People (Chicago: University of Chicago Press, 1979), p. 134.

40 Fiscal illusion techniques have been recognized for some time. David Boaz describes the 11 techniques of fiscal illusion discussed by economist Amilcare Puviani a century ago. David Boaz, The Libertarian Mind: A Manifesto for Freedom (New York: Simon and Schuster, 2015), p. 257.

41 Author’s calculation. By contrast, the government ran deficits just 32 percent of the years between 1791 and 1929.

42 Charles Wyplosz, “Fiscal Rules: Theoretical Issues and Historical Experiences,” National Bureau of Economic Research Working Paper no. 17884, March 2012, Table 1.

43 Robert Higgs, “Wartime Origins of Modern Income-Tax Withholding,” Independent Institute, December 24, 2007.

44 Washington Post, “Congress Irresponsibly Takes ‘Pension Smoothing’ from Exception to Habit,” editorial, August 19, 2014.

45 Chris Edwards and Nicole Kaeding, “Federal Government Cost Overruns,” Cato Institute Tax and Budget Bulletin no. 72, September 2015.

46 Ronald Reagan, “A Time For Choosing,” speech presented during the 1964 U.S. presidential campaign on behalf of Republican candidate Barry Goldwater, October 27, 1964. Reagan’s comment was nearly the same as one by Sen. James Byrnes on the floor of the Senate in 1933. See Chris Edwards, “Government Program Immortality,” Cato at Liberty (blog), Cato Institute, December 21, 2010,.

47 John Samples and Emily Ekins, “Public Attitudes toward Federalism,” Cato Institute Policy Analysis no. 759, September 23, 2014, pp. 3, 4.

48 Ibid.